We need HMRC to work better for ordinary taxpayers

Both fairness and our public finances depend on it (a guest post by Mike Lewis at TaxWatch)

This is a guest post by Mike Lewis, Director of TaxWatch.

It’s the kind of scandal that we’ve almost come to expect.

Whether it’s the Post Office’s Horizon prosecutions, or thousands of unpaid carers hounded for erroneous benefit overpayments, there is a growing feeling amongst the public that public-sector bodies enforce rules in ways that are rigged, or incompetent, or both.

The latest brick in this wall is the news, first reported by the Guardian, that HMRC appears to have frozen the child benefits of thousands of parents based on flawed travel data that incorrectly labelled many of them as having left the country.

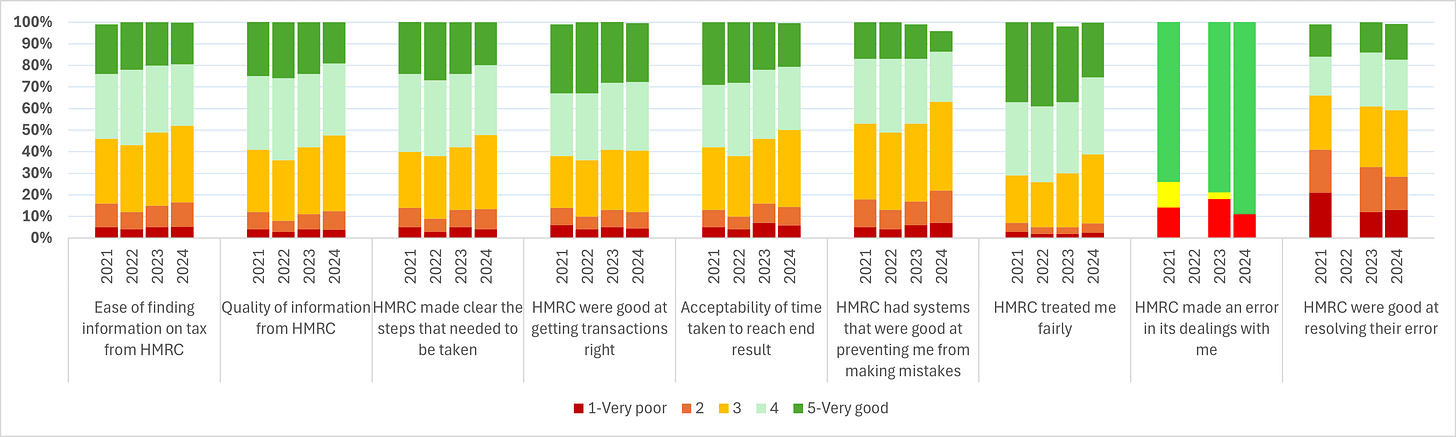

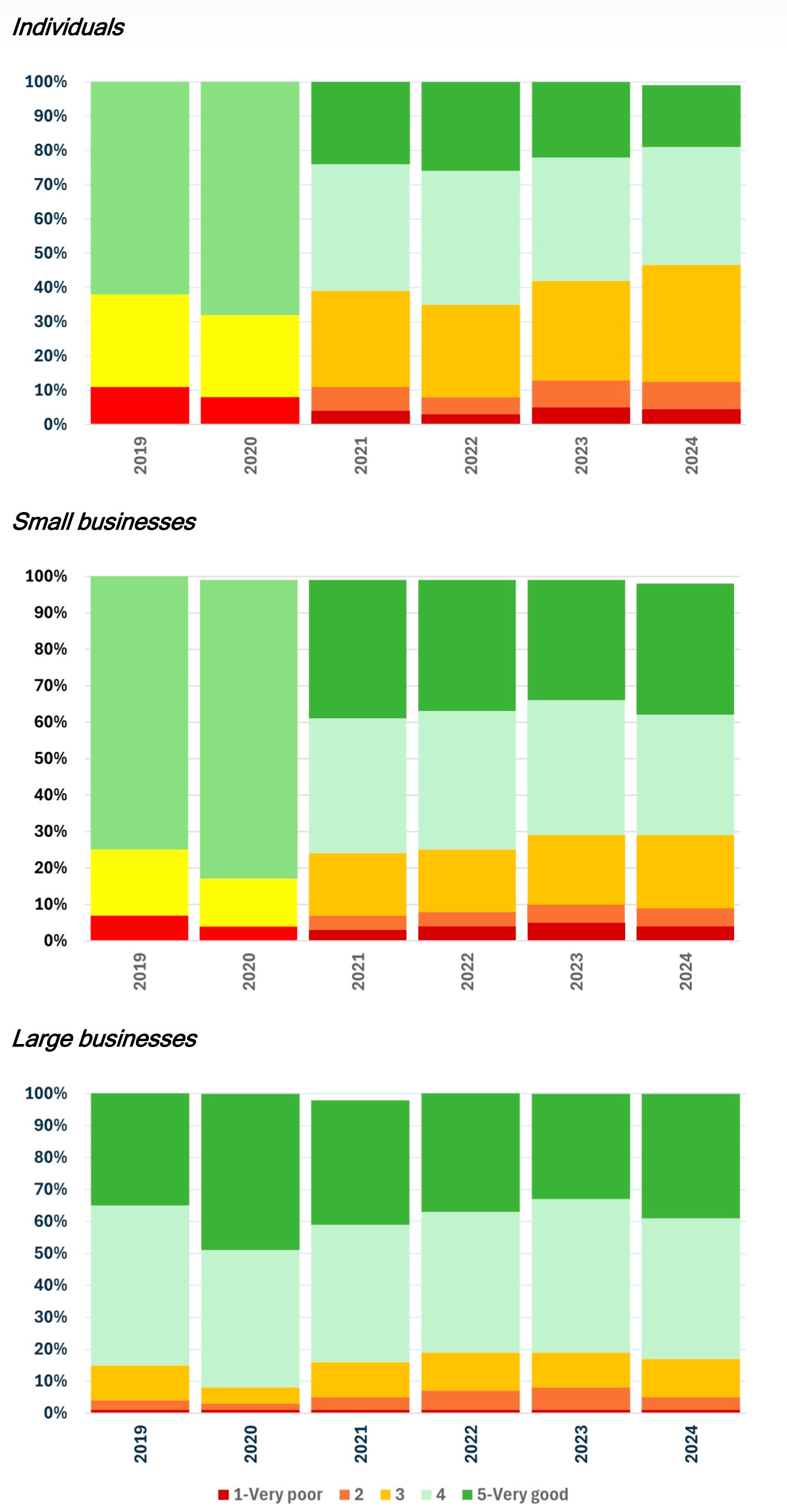

In HMRC’s case, public trust was declining even before these latest revelations. As TaxWatch highlights in its latest annual deep-dive into the nation’s tax administration, published last month, one in ten individuals and small businesses surveyed by HMRC reported that the tax authority had made an error in their dealings with them. Whether justified or not, just thirty percent of individuals surveyed last year agreed that “HMRC would admit if they made a mistake”. And just 52 percent of individuals who dealt with HMRC reported a good experience last year. This is an eight-year low.

These metrics also reveal a striking imbalance. The only category of taxpayer that is overwhelmingly and persistently happy with how HMRC treats them are the elite group of the 2,000 biggest corporate taxpayers serviced by HMRC’s “Large Business Directorate”. This is perhaps unsurprising: since they pay a very large proportion of Britain’s corporate tax take, these platinum-card taxpayers are accorded kid-glove treatment, each with an individual ‘compliance manager’. 83 percent of them reported a ‘good’ or ‘very good’ experience with HMRC last year, and 87 percent agreed that “HMRC treated my business fairly”, compared to only 61 percent of individual taxpayers.

Of course, few people like paying tax. It’s easy to dismiss dissatisfaction simply as the chagrin of the emptied wallet. But individuals’ and small businesses’ perceptions are to some extent backed up by the outcomes of complaints and appeals. Around half of all taxpayers’ complaints to HMRC about their treatment were fully or partially upheld last year, a 42 percent increase from pre-pandemic levels. Where taxpayers queried automatic penalties - for late payment or late submission of a tax return, for instance – over two-thirds found that HMRC had incorrectly applied the penalty. There were 70,000 such appeals last year, a five-fold increase since 2019. Some 100,000 late-filing penalties are given every year to low-income individuals who owe no tax at all. In the worst cases, where mental health or other problems prevent individuals from paying, these can spiral to five-figure sums.

HMRC is increasingly good at getting the big stuff right. It is protecting or recovering more missing tax than ever before. ‘Compliance yield’ reached £48 billion in 2024-25, up 15 percent from the previous year. But some areas of everyday and automated tax enforcement are either alarmingly error-prone, or hit the poorest hardest.

Beyond individual distress, this matters for two big reasons. First, if ordinary people don’t feel that HMRC applies penalties and sanctions fairly to all taxpayers (only 27 percent of surveyed individuals agreed with this in 2024, also a historic low) then they are less inclined to declare all their income properly and pay their taxes. Last week’s Budget promised a new 350-strong team of criminal investigators to crack down on small business tax fraud, especially on the High Street. On the demand side, though, the problem is growing. Over a third of small businesses’ tax returns mis-state their income by more than £1,000. This adds up to billions of pounds of missing tax revenue across the economy. Meanwhile huge out-of-court settlements between HMRC and non-compliant multinationals feed the impression, justified or not, that there’s one rule for small taxpayers and another for big ones.

Similarly, HMRC is currently pursuing thousands of small-scale contractors who were encouraged to buy into ‘disguised remuneration’ tax avoidance schemes in the 2010s, following a retrospective law change; at least ten have committed suicide under the pressure. However justified HMRC’s pursuit of these (often unsophisticated) tax scheme users may be, those who profited from organising such schemes, or more outright evasion, are often named but very rarely prosecuted. In 2017 the UK introduced a new corporate criminal offence of failure to prevent facilitation of tax evasion - intended in the wake of the HSBC Switzerland scandal to make banks and other firms pay if they helped others evade tax. It has taken until August 2025 for HMRC to bring the first prosecution under this law - against a small accountancy firm in the northwest of England. The case won’t even come to trial before mid-2027.

Second, this government’s tax and spending plans are unusually reliant on boosting HMRC’s ability to both inspire and enforce tax compliance. The untold story of last week’s Budget was that the Chancellor is betting the house on boosting HMRC’s ability to chase tax dodgers. Measures to close the unpaid ‘tax gap’ were the Budget’s third-largest revenue-raising measure, after income tax threshold freezes and pension national insurance changes. They are forecast to bring in an additional £2.6 billion by 2030-31. Together with measures announced in Autumn 2024 and Spring 2025, the government is now expecting to raise £8.8 billion annually from improved tax compliance by 2029-30: a policy expected to bring in more money than the ‘farm tax’, non-dom reforms or VAT on private school fees.

Yet only 0.4% of the staff that the Chancellor has promised to do this are yet in post. IT and comms systems are creaking. In some areas of tax compliance, like money hidden in offshore bank accounts, HMRC is benefiting from unprecedented data and disclosure, but still recovering less than half the amount of hidden tax liabilities in its own estimates.

If tax compliance doesn’t increase in the way that the government expects, the Chancellor’s promised spending plans, from SEND to child-related benefits, are simply undeliverable.

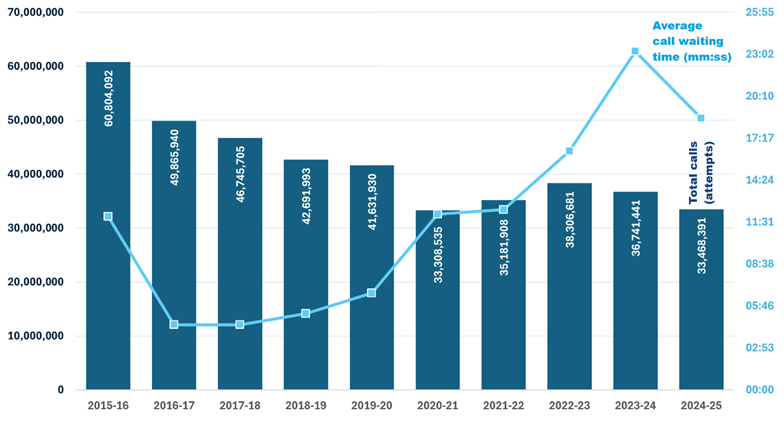

Investing in the UK’s tax authority is still amazingly good value. Every pound that HMRC spends on tax compliance brings in £23 of revenue, the kind of return on investment that many private-sector organisations can only dream about. But it needs to recruit and retain experienced staff – HMRC’s annual staff turnover is over eight percent, above the civil service average. It needs to fix its IT and communications systems: in contrast to the individualised ‘tax concierge’ type service that HMRC provides to large businesses, ordinary British taxpayers and their agents collectively spent 1,186 years waiting for HMRC officials to answer the phone in 2024-25, and twenty percent of their calls were never answered at all.

Critically, HMRC needs to make individual and small business taxpayers believe that they are being treated fairly. Tax incidence – who pays, and how much – is well-understood in tax policy, measured, and debated. Perhaps we also need to start measuring tax enforcement incidence – who gets made to pay, and how. The current government is betting the house on HMRC’s ability to make taxpayers pay more of their due taxes. Ensuring that tax enforcement is fair, and seen to be fair, isn’t just a question of fairness – it may have an outsize impact on the nation’s finances too.

TaxWatch’s annual ‘State of Tax Administration 2025’ report was published on 17 November 2025. It is available here.

This is a guest post by Mike Lewis, Director of TaxWatch.