Wealth Gap Risk Register

Our new report setting out the evidence base for the impacts of wealth inequality in the UK on our society, economy, democracy and environment, the policy solutions to tackle it, and public attitudes

Today we are launching a new report, the Wealth Gap Risk Register. Read the interactive online version (including a range of data visualisations), or download the PDF. We are running a webinar today to discuss the report’s findings - find out more here. We have also published an open letter to the Prime Minister.

Britain is a wealthy country, but its wealth is increasingly concentrated in few hands. While wealth inequality has remained fairly stable in relative terms over recent decades (with the richest 10% owning about 50% of the UK’s wealth), substantial rises in the value of assets have dramatically increased the absolute wealth gap between the richest and poorest households to a level that is second only to the USA, among OECD countries. As a result, wealth – or its absence – has a bigger impact on people’s lives than ever before, from their housing to their health.

The fact that much wealth is unearned raises serious questions of fairness, but the size of the wealth gap also has demonstrably negative impacts on our economy, society, democracy and environment. Contrary to the orthodox idea that inequality is necessary for a dynamic economy, growing evidence suggests that wealth stratification undermines productivity and growth. It also reduces social cohesion, damages faith in democracy, and makes it harder to reach net zero. What’s more, as the size of the wealth gap is forecast to grow over the coming decades, the risk is that these existing impacts, which also exacerbate each other, will only get worse over time.

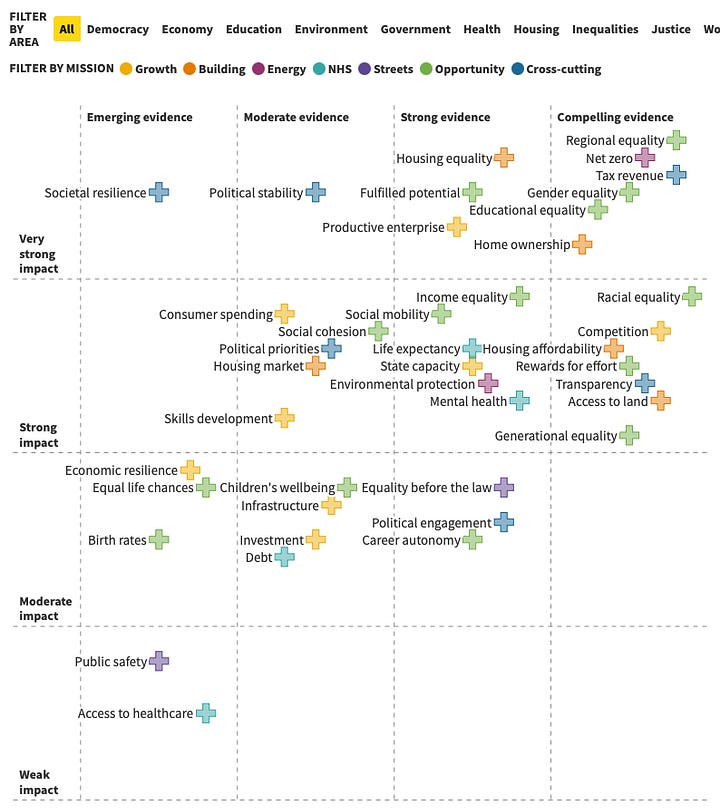

There is limited policymaker and public understanding of the causal relationship between the wealth gap and these negative ‘spillover effects’, so this report sets out to communicate the evidence base as clearly and concisely as possible through a range of powerful and accessible data visualisations. The report also looks at the evidence base for the policy solutions that will either reduce the wealth gap or mitigate its impacts on other areas, and at the evidence on public attitudes to both the problem and the solutions (including new polling and focus group research on public understanding of the impacts of wealth inequality).

Why wealth inequality is a risk

When we think about identifying and mitigating risks, there’s a natural tendency to focus on immediate symptoms rather than underlying causes. At a governmental level, the UK’s national risk register has recently narrowed its focus to ‘acute’ risks (“discrete events requiring an emergency response”, such as terrorism and natural disasters), sensibly placing ‘chronic’ risks (“long-term challenges that gradually erode our economy, community, way of life, and/or national security”, such as the climate crisis or antimicrobial resistance) into a separate chronic risk register, which is currently in development. But it does not automatically follow that the underlying causes, the structural factors that create or exacerbate many risks, will receive the attention that they deserve.

We think that inequality, especially wealth inequality, is a significant driver of strategic risk to the UK as a whole, and that this is seriously underpriced – by politicians and officials, by the private sector, and by all of us. Wealth inequality seriously exacerbates a wide range of arguably existential risks, such as social unrest, failure to act on the climate crisis, economic stagnation and the decline of democracy. And wealth inequality is a major risk to the achievement of all five of the government’s missions.

This report is called the Wealth Gap Risk Register. This arguably understates the problem, because the negative impacts of wealth inequality aren’t just hypothetical future risks, but rather impacts that have already been realised. However, there are plenty of reasons to expect that the wealth gap in the UK will continue to widen over the coming years, so the obvious risk is that each of these existing impacts worsens over time. And since many of these impacts interact and reinforce each other, just as different forms of inequality intersect and exacerbate each other, it is not unrealistic to speculate that we could see the negative impacts of wealth inequality snowballing in the UK over the next couple of decades, and beyond, if action is not taken to reduce the wealth gap or to mitigate its impacts (or ideally both).

The argument in a nutshell

Rising wealth has created large gaps between those with wealth and those without it. While wealth inequality (understood in relative terms, as measured by the Gini coefficient) has remained relatively stable over recent decades (albeit at a much higher level than income inequality), the wealth gap (the absolute difference in wealth between rich and poor households) has increased significantly, because of rising asset values, and is likely to get worse. The size of the absolute wealth gap in the UK is second only to the US.

Differences in wealth between generations are also at unprecedented levels. While most of the 20th century saw each generation accumulating more wealth than their predecessors, this trend has stagnated or reversed since the baby boomers and is gathering speed in the wrong direction.

The transformation of the UK economy towards asset control and rent-seeking behaviour – away from wealth creation towards wealth extraction – has consolidated resources into fewer hands and shifted economic activity away from productive enterprise. This has concentrated UK markets, restricted innovation and technological progress, reduced economic dynamism, and severely limited economic growth and the prospects for future growth. Whereas wealth creation increases the size of the cake, wealth extraction simply gives more of the existing cake to those who already have the biggest slice (upwards rather than downwards redistribution), and sometimes it makes the cake smaller at the same time.

Much wealth in UK is unearned, flying in the face of the dominant meritocratic political and media narrative that justifies the accumulation of wealth as a consequence of effort and talent. The large increase in asset prices over the past decades has largely been the result of passive factors. According to the most recent statistics, inheritance and gifts have doubled over the past two decades to £100 billion, and are expected to double again by 2040. Wealth transfers between generations will likely exacerbate existing social and economic inequalities. People’s life prospects weren’t very fairly distributed when they were mostly defined by what they earned; today, when what people own (or inherit) is much more important in influencing their life chances than what they earn, the situation is even less fair.

While there is limited public awareness of the ways in which wealth inequality undermines economic growth, and the meritocratic mindset retains a strong grip on worldviews, most people have an intuitive understanding that the increasing wealth gap is unfair in terms of both its causes and its consequences. Indeed, the growing level of popular disengagement and distrust with politics is in part driven by this awareness, and is already damaging our democracy and social cohesion, with a real risk of much worse to come in the future.

The problem is solvable. Shifting the UK's tax burden towards wealth could curb today’s excessive levels of wealth concentration. Reforming existing taxes on wealth would be more politically feasible than introducing a new wealth tax, but less effective at tackling wealth inequality. But taxing wealth is not the only means to curb the wealth gap. Governments can share wealth more broadly at source, through mechanisms like sovereign wealth funds or regulatory approaches such as mandating worker representation on company boards. And there are many opportunities to mitigate the impacts of the wealth gap, such as cleaning up lobbying and political donations, or strengthening the social safety net. Case studies from other countries provide a host of practical, popular and evidence-based approaches to curbing wealth extraction and promoting inclusive and sustainable economic growth.

This is an extract from our new report published today, the Wealth Gap Risk Register. Read the interactive online version (including a range of data visualisations - see the screenshots below), or download the PDF. We have also published an open letter to the Prime Minister.

Sign up for our webinar today, where we’ll discuss the report’s findings with an expert panel including Liam Byrne MP, Sonia Sodha of the Observer and Graham Hobson of the Patriotic Millionaires.